How manufacturing location is impacting the state of the global industrial supply chain

As industrial supply chain complications continue, the future of global exports-at-large remains uncertain.

Could a focus on where you manufacture hold the answers to the best path forward?

You see it everywhere you go – from empty holes on grocery store shelves, to the department stores not yet putting seasonal items on sale, to the lack of industrial warehouse space available to help with current shortfalls – the supply chain feels broken and has many asking: how did we get here?

The impacts of supply chain snags are global as minor snags here and there turned into major headaches for all as demand continually outpaced supply across industries, and logistics getting goods from point A to point B during times of border and port closures provided challenge after challenge.

Even as we begin to navigate toward greater states of “normal,” it could take quite some time still to fully recover or repair the deep impacts that have been made across our global supply chain networks.

What do the markets look like today, what are we keeping an eye on, and could the best path forward be shifts in manufacturing closer to home? We explore below.

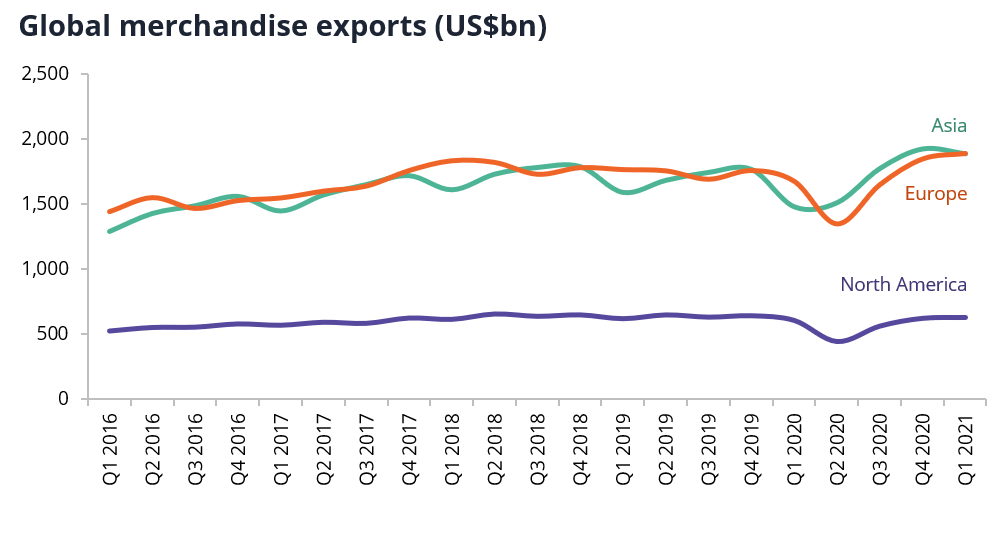

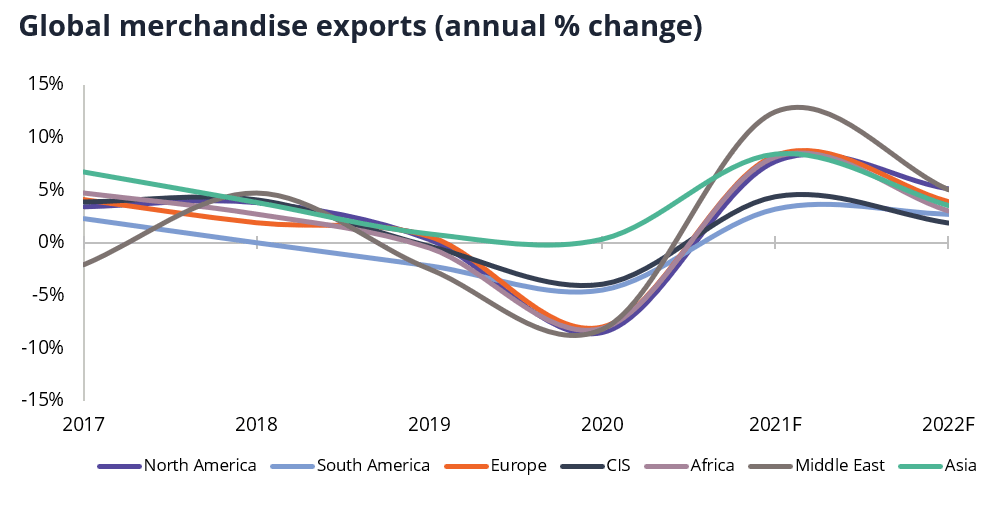

The state of exports remains at or below pre-pandemic levels

Despite early recoveries in the merchandise trades in Q1 2021, and some successes in early 2021, exports of some economies remain at or below pre-pandemic levels, with all markets favoring the best ways to improve or future-proof their prospects.

Source: WTO, Broker notes, Factiva, Bloomberg

Driven by factors like the U.S.-China trade war, strained relationships within the European Union and China, and others, global supply chain markets remain at a slow recovery rate.

But as we explore talks of trade wars, agreements and strained international relationships, there are equally important conversations happening around manufacturing options, ESG, and which materials are finding ways to thrive through it all that could hold important answers to the future of the global supply chain.

We dive into each of these topics and their impact below.

There is a careful watch on trade wars and agreements worldwide. Nations are in a fight to remain competitive and exploring alternatives for their manufacturing strategies.

It’s no secret that both trade wars and trade agreements between countries can have a massive impact on the state of supply chain, and right now we are seeing that unfold in real time.

Notably, the world’s trade relationships with China, as the European Union declares the country “an economic competitor in pursuit of technological leadership and a systemic rival promoting alternative models of governance.”

This has led to a sanctions war between China and the EU, hurting trade relations and causing former allies around the world, like Italy and the Netherlands, to try and block China’s attempts to advance.

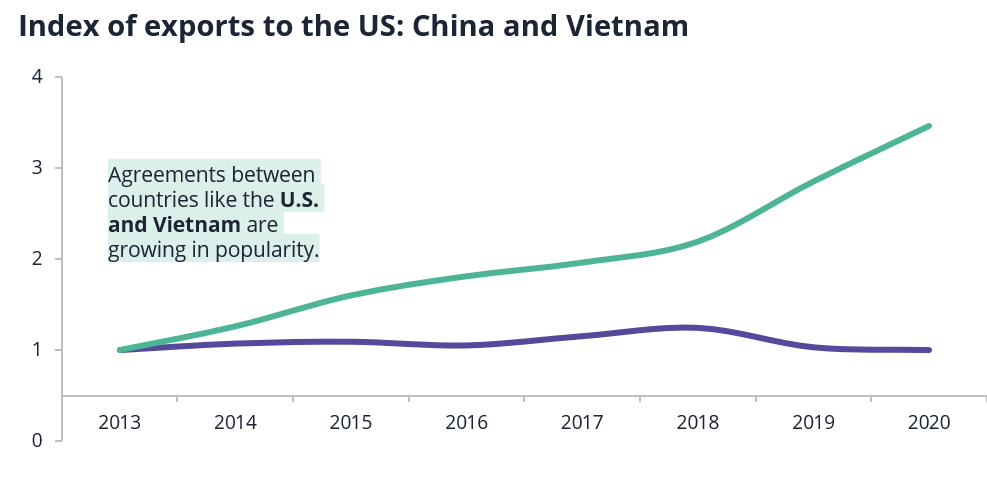

Similarly, the U.S.-China trade wars centered around emerging technologies remain, with aims to slow China’s hold as a leader in 21st century industries, and go after stakes in critical exports, such as cobalt and lithium.

This has all led China to its own retaliations, leveraging critical allies, using Belt & Road investment projects, favoring quantity of output over ownership and IP, and military strength against other Asian countries to maintain strongholds, with no clear end in sight.

In turn, countries like the U.S. are exploring options for manufacturing outside of China, growing popularity in agreements with countries like Vietnam and Malaysia.

Source: Broker notes, Factiva, Bloomberg, Reuters, Forbes, AT Kearney

Time will tell, but for now, companies are likely to consider new approaches to move manufacturing away from China. This means relying on countries like Vietnam as well as considering nearshore or other attractive options for their long-term strategies.

Reshoring vs near-shoring vs off-shoring: as countries decide the best long-term strategies for their manufacturing needs, many may start looking as close to home as possible.

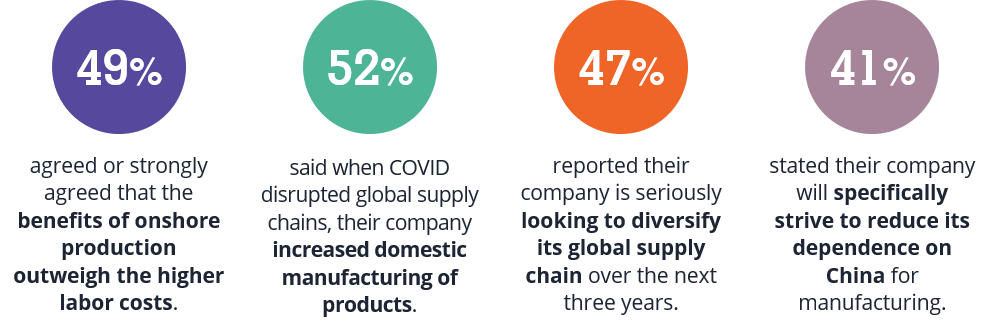

On-going supply chain disruptions. The pandemic. China’s trade discussions with the EU and U.S. These are just a few of the big factors that have led supply chain leaders worldwide to rethink their existing supply chains.

According to a recent C-suite survey conducted by UBS Evidence Lab, 70% of respondents expressed reshoring intentions, with views that offshoring is in structural decline and domestic productions more favorable than ever before.

Trends in reshoring are also evident based on a sharp increase in corporate reshoring announcements seen in 2021 so far.

And large retailers and supply companies facing current stock crisis are getting creative – looking toward unique solutions like chartering their own cargo ships to reach waiting cargo holds and secure their imported goods.

A recent survey to gauge reshoring intent by AT Kearney solidifies our view that practices across the chain are being rethought with the following findings:

Source: Broker notes, Factiva, Bloomberg, Reuters, Forbes, AT Kearney

“Another trend we’re seeing specifically in North America is nearshoring – bringing manufacturing operations to emerging markets closer to the U.S. to enable supply chain optimization.,” said J.C. Renshaw, Avison Young Director of Supply Chain Consulting, “Businesses looking to diversify their supply chains see Mexico as a viable nearshoring option, particularly for industries such as automotive, aerospace, and electrical components, where Mexico has existing infrastructure and skilled labor.”

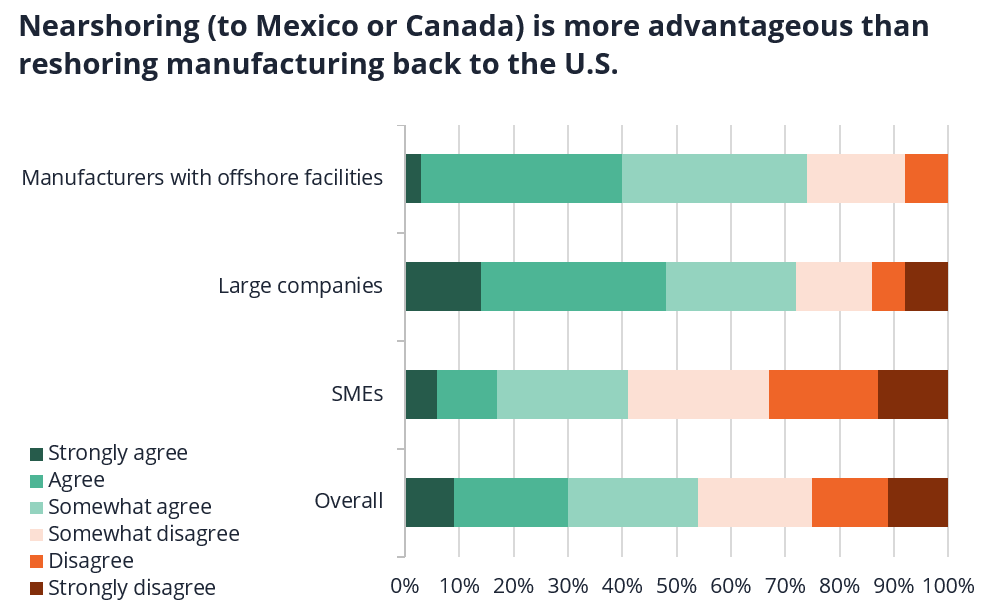

Nearshoring (to Mexico or Canada) is more advantageous than reshoring manufacturing back to the U.S., according to survey results

Source: Broker notes, Factiva, Bloomberg, Reuters, Forbes, AT Kearney

It’s clear that much is being rethought across the chain from suppliers worldwide. In a follow-up piece, we explore the impact of ESG (environmental, social and governance factors) as well as the various materials sectors’ performance against the current state of the global supply chain.

Key takeaways

− Despite some recoveries, many economies remain below pre-pandemic numbers.

− Trade wars and agreements, notably revolving around China, have led to increased fluctuations in the markets, and desires for suppliers to consider new supply options to remain competitive against China’s strongholds.

− Companies are looking closer to home, mixing up shoring prospects for those at home, nearby or notably advantageous in the market.